Guide to e-invoicing requirements in Spain

While timelines have shifted and technical details are still being finalised, the direction is clear: digitisation is...

Dive into the details of Sweden’s e-invoicing regulations. Ready to get started with e-invoicing?

Electronic invoicing is becoming increasingly essential for businesses in Sweden, particularly for those working with the public sector. Since 2019, Sweden has implemented regulations to streamline invoicing processes and improve transparency.

Since 2019, all invoices sent to the public sector (government agencies, municipalities, and regions) must be electronic

E-invoicing is not mandatory between businesses, but widely adopted due to efficiency, cost savings, and digital transformation trends

Despite not being mandatory, B2C e-invoicing is becoming more popular due to its convenience and efficiency for both businesses and consumers

The consumers can receive electronic invoices through their online banking services or digital mail applications

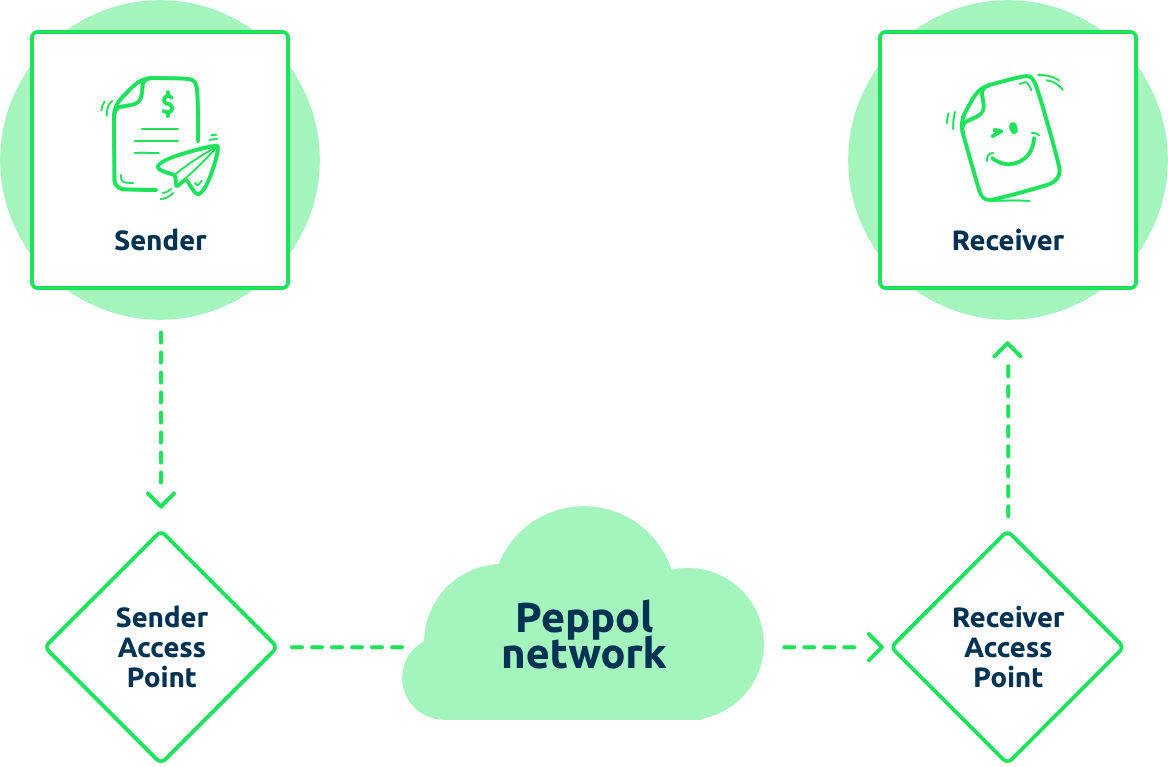

Peppol is a widely used format, and its network usage is on the rise. The operator network remains the primary channel for most invoices, accommodating both Peppol and Svefaktura formats

Businesses must ensure their e-invoicing solution supports Peppol BIS Billing 3.0 if working with public entities

E-invoices must comply with Swedish VAT laws and record-keeping requirements set by the Swedish Tax Agency (Skatteverket)

Our guide for software vendors

Maventa - the only Peppol Access Point you need

As a trusted and experienced Peppol service provider, we connect your software and your customers to the Peppol network safely and securely, with no extra costs.

While timelines have shifted and technical details are still being finalised, the direction is clear: digitisation is...

For software vendors and platforms, understanding the essentials of the Italian approach to e-invoicing is crucial to...

.jpeg)

What do these mandates mean for your business? This guide provides an overview of the most important e-invoicing...