Guide to e-invoicing requirements in Spain

While timelines have shifted and technical details are still being finalised, the direction is clear: digitisation is...

Get up to date of Poland’s e-invoicing regulations and get started with e-invoicing today.

Poland is undergoing a significant digital transformation in its invoicing landscape, with mandatory e-invoicing for B2B transactions now implemented in phases through the National e-Invoicing System (KSeF 2.0), which launched on February 1, 2026, building upon the existing B2G framework.

Since April 2019, all public sector entities are required to receive and process structured e-invoices compliant with the European Standard (EN 16931)

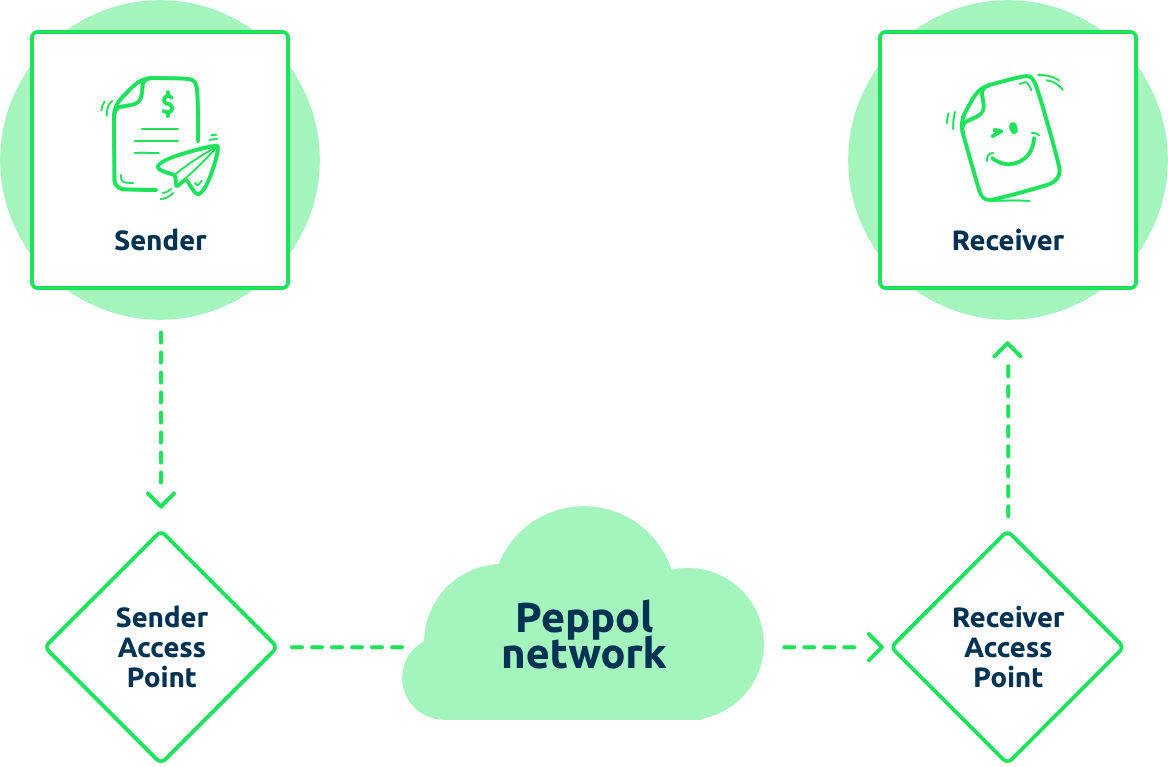

The national e-invoicing platform, PEF (Platforma Elektronicznego Fakturowania), operates within the OpenPeppol network and is used for B2G transactions

Businesses supplying goods or services to public authorities are encouraged to issue structured e-invoices compliant with EN 16931, as this guarantees acceptance.

E-invoicing is now mandatory for domestic B2B transactions through the National e-Invoicing System (KSeF 2.0), which officially launched on February 1, 2026

The implementation is phased:

February 1, 2026: Mandatory for large taxpayers (those with annual revenue exceeding PLN 200 million in 2024)

April 1, 2026: The mandate extends to all other VAT-registered taxpayers

January 1, 2027: The mandate becomes effective for micro-businesses with monthly sales under PLN 10,000 and invoices under PLN 450

KSeF 1.0 and the MCU (Certificates and Authorizations Module) ceased functioning on February 1, 2026, with businesses required to migrate to the new KSeF 2.0 Taxpayer Application

Issuing consumer (B2C) invoices through KSeF is optional. Paper or PDF invoices will remain allowed for B2C transactions

If a B2C e-invoice is issued via KSeF upon a consumer's request, it will need to be delivered outside KSeF with a QR code via a method agreed with the consumer

Since January 1, 2026, companies can issue e-invoices with attachments through KSeF, but must submit a notification through the e-Tax Office declaring their intention

Poland has adopted the European e-invoicing standard EN 16931

Peppol BIS Billing 3.0 is utilised as the national Core Invoice Usage Specifications (CIUS) for B2G transactions via the PEF platform

For B2B transactions, the KSeF 2.0 system requires invoices in its proprietary XML format FA(3), which replaced the previous FA(2) structure with the launch of KSeF 2.0 on February 1, 2026

KSeF 2.0 Launch: The production API opened on January 28, 2026, allowing businesses to perform final integration tests before the February 1 mandate took effect

E-invoices must comply with Polish VAT laws and record-keeping requirements

The archiving period for electronic invoices in Poland is 5 years. KSeF will also serve as a repository, storing electronic tax documents for up to 10 years

The KSeF system is designed to enhance VAT collection efficiency and provide greater security for commercial transactions

KSeF 2.0 Taxpayer Application: This new platform replaced the MCU (Certificates and Authorisations Module) on February 1, 2026, serving as the central hub for managing mandatory technical requirements

Digital Identity Management - The "three pillars" businesses must manage:

Migration Considerations:

Attachment Functionality: Since January 1, 2026, companies can submit invoices with attachments, but must file a notification through the e-Tax Office

Maventa - the only Peppol Access Point you need

As a trusted and experienced Peppol service provider, we connect your software and your customers to the Peppol network safely and securely, with no extra costs.

While timelines have shifted and technical details are still being finalised, the direction is clear: digitisation is...

For software vendors and platforms, understanding the essentials of the Italian approach to e-invoicing is crucial to...

.jpeg)

What do these mandates mean for your business? This guide provides an overview of the most important e-invoicing...