Guide to e-invoicing requirements in Spain

While timelines have shifted and technical details are still being finalised, the direction is clear: digitisation is...

Dive into the details of Latvia’s e-invoicing regulations and get started with e-invoicing today.

Latvia is on a path towards a fully digital invoicing environment. With a mandatory B2G e-invoicing already in effect and a phased approach for B2B transactions, businesses in Latvia need to prepare for these changes.

Since January 1, 2025, all suppliers sending invoices to Latvian budgetary institutions (state or municipal entities) must submit them as structured e-invoices

January 1, 2026, the reporting of this e-invoice data to the State Revenue Service (SRS) for B2G and G2G transactions will become mandatory

The e-invoices must comply with the European Standard (EN 16931) and specifically the Peppol BIS Billing 3.0 standard

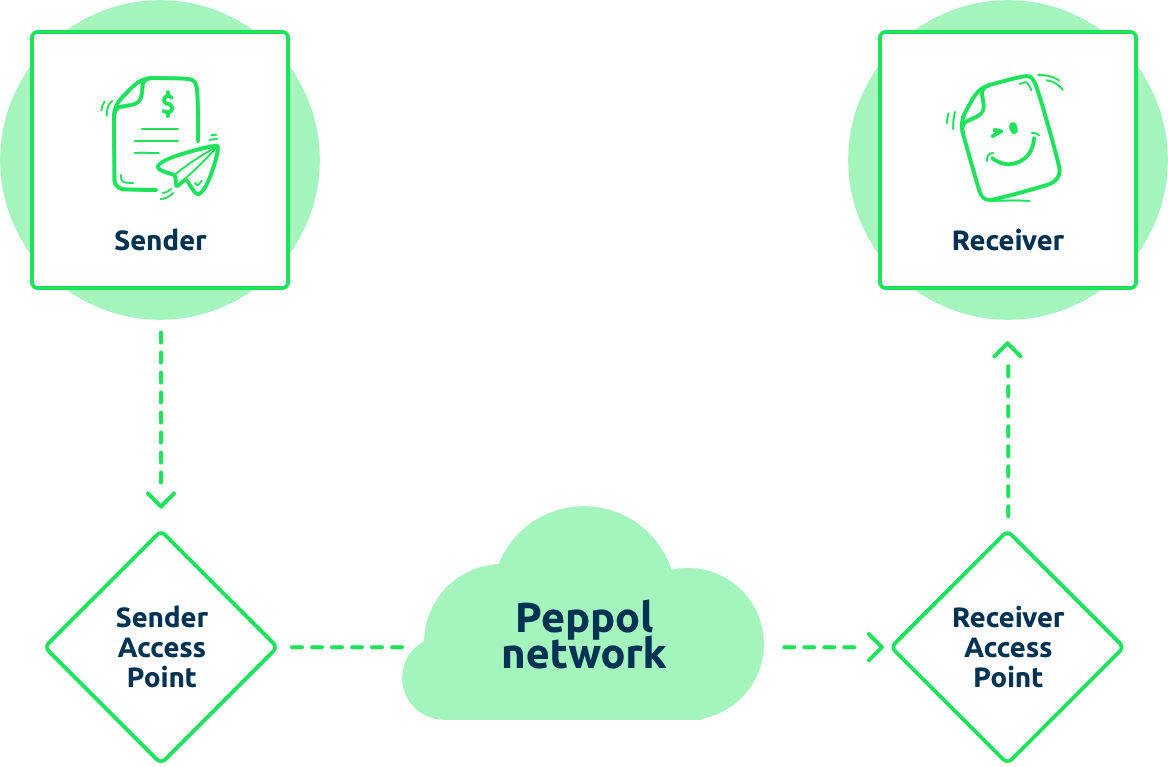

E-invoices for B2G transactions can be transmitted via the national e-Address (e-adrese) portal or through certified Peppol Access Points

The mandatory use and reporting of e-invoices for domestic B2B transactions will begin on January 1, 2028.

A voluntary phase for B2B e-invoicing is planned to open on March 30, 2026, allowing businesses to begin adopting structured e-invoices early

Latvia has opted for a decentralised Continuous Transaction Controls (CTC) model for B2B e-invoicing, with the e-invoice data being submitted to the SRS

The Peppol BIS Billing 3.0 is expected to be the mandatory format for B2B transactions once the mandate comes into full effect, aligning with the EU's VAT in the Digital Age (ViDA) initiative

Latvia has adopted the European e-invoicing standard (EN 16931)

Peppol BIS Billing 3.0 (based on UBL 2.1 XML) is the cornerstone for both B2G transactions and is anticipated to be the mandatory standard for B2B transactions

The e-Address (e-adrese) portal serves as a national platform for exchanging e-invoices with public entities. Businesses will also be able to use commercial e-invoicing operators, including Peppol Access Points, for transmission

E-invoices must comply with Latvian VAT laws and record-keeping requirements

The archiving period for e-invoices in Latvia is generally 5 years for goods and services invoices, and 10 years for real estate-related invoices, from the end of the tax year

The introduction of mandatory e-invoicing is part of Latvia's broader strategy to combat the shadow economy, improve VAT compliance, and provide tax authorities with near real-time access to transaction data.

Further technical and procedural requirements, especially for B2B e-invoicing, are expected to be fully defined by the State Revenue Service.

Maventa - the only Peppol Access Point you need

As a trusted and experienced Peppol service provider, we connect your software and your customers to the Peppol network safely and securely, with no extra costs.

While timelines have shifted and technical details are still being finalised, the direction is clear: digitisation is...

For software vendors and platforms, understanding the essentials of the Italian approach to e-invoicing is crucial to...

.jpeg)

What do these mandates mean for your business? This guide provides an overview of the most important e-invoicing...