Guide to e-invoicing requirements in Spain

While timelines have shifted and technical details are still being finalised, the direction is clear: digitisation is...

What does e-invoicing look like in Germany? Dive deeper to understand the regulatory landscape of Germany!

The current invoicing landscape in Germany varies between states, owing to the de-centralised federal structure. In an effort to bring more standardisation, more security, and more efficient invoicing processes across Germany, e-invoicing is set to become mandatory for all private companies. The phased roll-out of the mandate begins in 2027.

E-invoicing is currently mandatory in 7 states: in Hamburg, Bremen, Hessen, Baden-Württemberg, Saarland, Mecklenburg-Varpommern, and Rheinland-Pfalz

From 1 January 2025, all German companies must be able to receive e-invoices

Starting from 1 January 2027, e-invoicing will become mandatory for all large and medium companies

Peppol BIS 3.0

XRechnung

ZuGFeRD.

The archiving period for e-invoices is 10 years

Our guide for software vendors

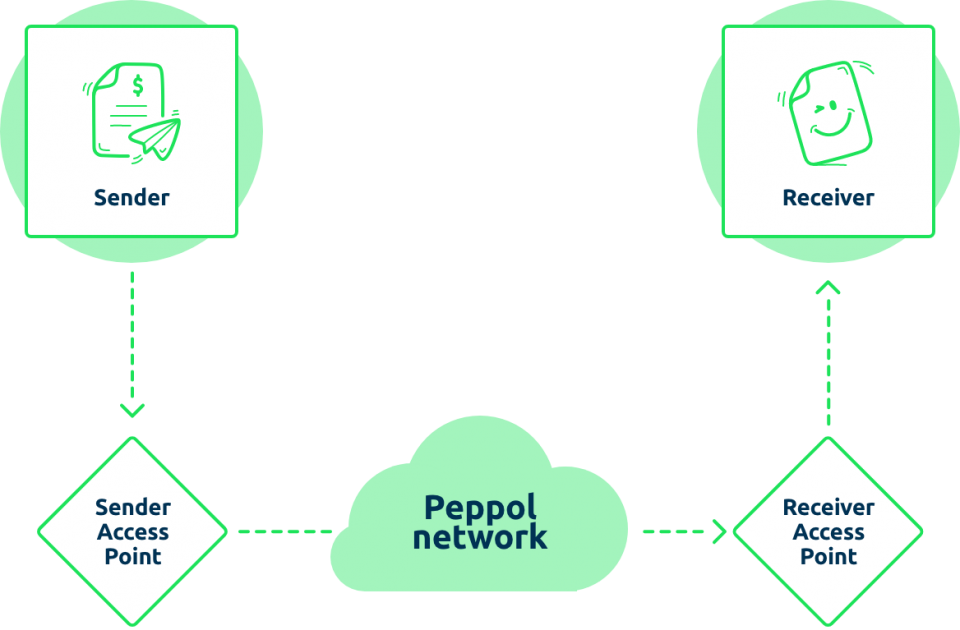

Maventa - the only Peppol Access Point you need

As a trusted and experienced Peppol service provider, we connect your software and your customers to the Peppol network safely and securely, with no extra costs.

Please tell us a bit more about your e-invoicing needs and our experts will get right back to you.

While timelines have shifted and technical details are still being finalised, the direction is clear: digitisation is...

For software vendors and platforms, understanding the essentials of the Italian approach to e-invoicing is crucial to...

.jpeg)

What do these mandates mean for your business? This guide provides an overview of the most important e-invoicing...